JFTfunds offer manage accounts for retail investors, who have neither the time nor expertise to trade their own account.

A managed account is a type of investment service which selects a group of funds and packages them in an investment portfolio for an individual. The individual investor owns the account, but it’s overseen by a professional money manager whom they’ve hired on their behalf. The manager may buy, sell, or trade assets without the investor’s prior approval.

If you’ve researched the world of investment, you’ve probably heard the term “managed account” once or twice. But what does it even mean? Who’s managing what account? If you’re a little fuzzy on the distinction, or in need of a refresher course, this post will equip you with all the necessary information.

A managed account is a type of investment service which selects a group of funds and packages them in an investment portfolio for an individual. The individual investor owns the account, but it’s overseen by a professional money manager whom they’ve hired on their behalf. The manager may buy, sell, or trade assets without the investor’s prior approval -so long as it’s in accordance with the objectives of their client.

A managed account always involves fiduciary duty, which mandates the manager to act in the best interest of the client or potentially risk facing criminal penalties. To answer the question, “What is a managed account?” it’s best to first become familiar with the various types of accounts investors use to their advantage.

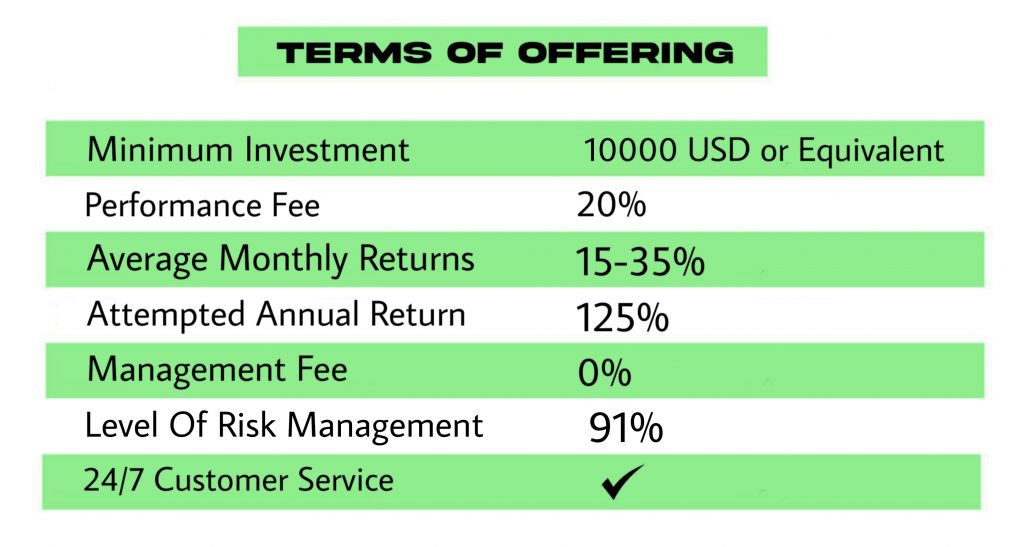

At JFTfunds, we don’t believe investors should chase the market, and should instead use it to their advantage. Don’t play the lottery with your retirement funds; apply a carefully chosen amount of risk to help you reach your goals and desired outcome.

Our methodology balances avoiding risk while seeking reward and employs a proprietary methodology designed to achieve steady, long-term growth. We can help you make smart tradeoffs while avoiding unnecessary risks..

Using a discretionary approach, trades are entered manually when a combination of historically proven technical indicators signal a potential low risk entry.

The goal of this strategy is to make few yet conservative trades with the aim of providing the investor with a monthly profit in volatile market conditions, Positions are kept open until such time as either a protective stop order is triggered guaranteeing a safe predefined loss, or a trailing stop/limit order is triggered thus locking in profits.

It should be noted that extremely volatile market conditions may prevent stop/limit orders from being triggered.

Strict money management methods are incorporated in order to preserve capital and produce the maximum return for investors.

So we using a discretionary approach, trades are entered manually when a combination of historically proven technical indicators signal a potential low risk entry and using risk management.

Generally advantage is taken of the spot overnight rollover interest payments made on the leveraged size of the trades.

The managed account Programs use Asset Pairs.

If you already have a 401(k) or an IRA, roll it over to JFTfunds for managed investing from industry-leading professionals. The process is fast and easy. Most people are unaware of how much their retirement plan is costing them; between account and administrative fees, costs of funds and charges for management advice, a large portion of your potential savings are siphoned off never to be seen again.

JFTfunds doesn’t believe in erroneous charges or hidden fees, and instead offers the entire benefit package within our managed account programs at one low, flat cost.